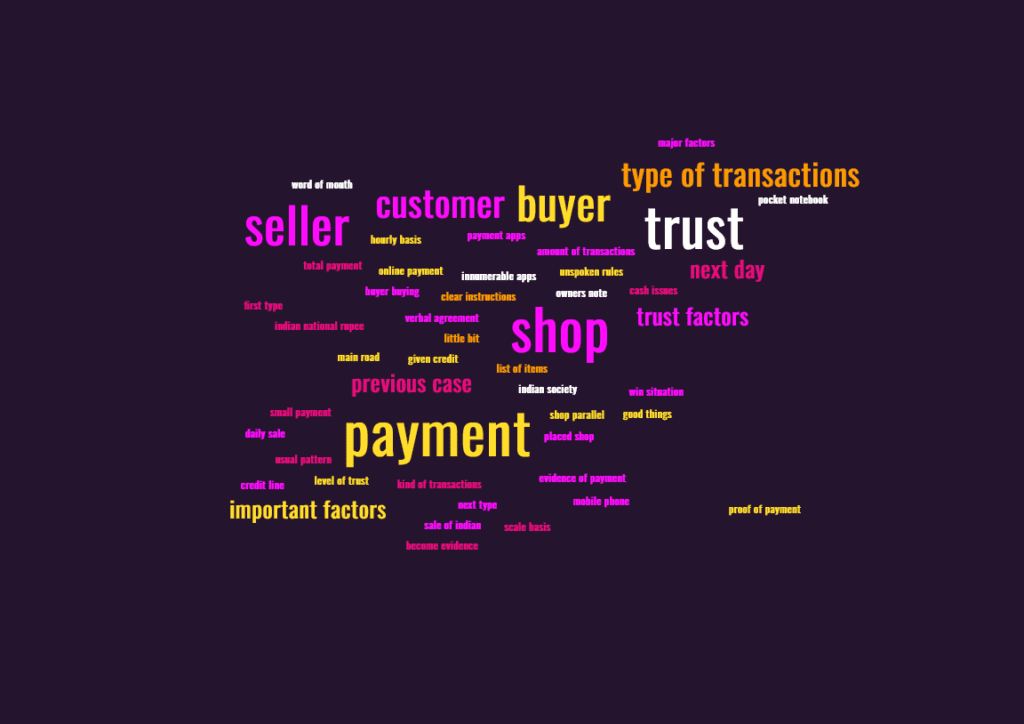

BNPL – A new version based on trust

Did you know that as a businessman/businesswoman you can apply this simple technique? Yes, even without using the innumerable apps available today employed by nearly most major businesses using this technique, i.e., ‘Buy now, pay later’! This is possible and can be done at least on a small-scale basis. But trust is the most important factor. And thus this forms the basis for a new and unique version of BNPL!

Trust – Numero Uno factor for any business

Let me explain – what draws any customer towards any business? The familiarity between the seller and the buyer, word of mouth, ease of doing business. The last factor mentioned might be as simple as accessibility for a retail (‘Kirana’ in India) store. For example, a shop might have steps to ascend vs. shop parallel to the ground, etc. But like I said before – trust is the most important factor.

What happens in most of the Kirana stores in India is that the customer might be given credit – mostly for a month. The customer buys the items s/he wants, the seller notes it down in his account noted down in a notebook. Yes, this is the usual pattern. But now times have changed. What I am talking about is today’s age where online payments have become ubiquitous, what with the COVID-19 changing the situation forever! People from all strata of Indian society are doing payments using apps like PhonePe, GPay, etc. And for those who have cards like Visa, just waving the card at a device for small payments has become the norm!

Helping ‘Mom & Pop’ stores

I am talking about something else. Suppose A has an acquaintance, X who has a shop a bit interior (away from the main road), maybe at his home itself. Mrs. X looks after the shop besides attending to her household affairs. So, X requests A to buy stuff from his shop. Mr. A usually calls up or uses WhatsApp to message the list of items required.

A goes to the shop, buys the stuff, and moves away – the shop-owner notes down the amount for which items were bought, A too usually notes down immediately in a note in his mobile phone/pocket notebook or he goes away with the stuff and notes it down later. Due to the trust factor involved, there’s no need to even use payment apps. Because the net/total payments can be done at the end of the month or bi-monthly (twice in a month).

Or as per the verbal agreement/arrangement between the seller and the buyer. This is a win-win situation for both parties involved. How? Say, the seller has a target of daily sales of Indian National Rupees (INR) 2,000. The buyer buying at his shop regularly would be helping the seller achieve his/her target. At least in a small way!

But once again, as I have mentioned before, trust is the major factor involved in these kinds of transactions. And hey yes, whenever a payment is done, the screenshot of the payment is shared via WhatsApp immediately. Thus, WhatsApp has become evidence of payments in today’s age.

BNPL but ultra-fast payments required!

The next type of transactions too are built on trust but the level of trust is on either a daily or probably even an hourly basis. Let me explain – there are some people for whom money is everything in life. These shopkeepers never give loans to anyone – there are clear instructions prominently hung in their shops displaying the same. But they do make exceptions in very few cases but the unwritten/unspoken rules are VERY CLEAR!

The amount of transaction is noted down then and there or later as in the previous case. But the payment too is done as soon as possible (ASAP) preferably within the end of the day (at least until midnight) or the next day at the most! Of course, here too, WhatsApp is the de facto proof of payment! A trust exists in these types of transactions too but the duration of the trust is smaller than in the previous case. Trust me, if the payment is not done, the shopkeeper might gently remind the buyer about the payment in his/her next visit the next day or whenever they meet again.

BNPL but with at least 15-30 days of credit – Best!

Any buyer would prefer the first type of transaction because of the credit line extended by the seller. The transactions would be higher in the former unless the shop as was explained in the example for the former is a little bit interiorly placed. But still, if the seller has any cash issues/problems, s/he would prefer the former. The seller prefers the latter only in cases when s/he is unable to go to the interiorly placed shop in the former or due to other factors – for example, the items to be bought are not available in the former.

But the good thing is that the buyer (due to the trust factor involved) needn’t wait, unlike other customers for paying – s/he can just buy, make a physical note (or a mental one to be entered later in the physical space), and move on.

Good option but as you mentioned trust is the main factor or if you have this system approved by government where banks will hold the transaction amount and release eventually monthly as decided.